DOJ Charges Amalgam Founder With Crypto Fraud: A Case Study in Deception

The Justice Department has unsealed criminal charges against Jeremy Jordan-Jones, alleged founder of the now-defunct crypto venture Amalgam, accusing him of orchestrating a $1 million investor fraud built on fabricated partnerships, fictitious technology, and the trappings of blockchain legitimacy.

The indictment is the latest in a growing string of federal enforcement actions targeting fraudulent schemes masquerading as legitimate digital asset businesses. The message from prosecutors is clear: the novelty of blockchain will not shield bad actors from traditional fraud charges.

Super Micro Subpoenaed by DOJ and SEC Following Short Seller Allegations: What This Means for AI Market Investors and Compliance Officers

San Jose-based Super Micro Computer, a prominent supplier of high-performance AI server hardware, disclosed this week that it has received subpoenas from both the U.S. Department of Justice (DOJ) and the Securities and Exchange Commission (SEC). The subpoenas, served in late 2024, are part of an apparent response to allegations first raised by the now-defunct short seller Hindenburg Research in August of last year.

Tether CEO Acknowledges Vulnerability to U.S. Government Control Amidst Renewed Scrutiny

As Tether, the largest stablecoin issuer in the crypto market, faces increasing regulatory pressure, CEO Paolo Ardoino recently underscored the company’s complex relationship with U.S. authorities in an interview with CoinDesk. Despite Tether's compliance with international sanctions and cooperation with law enforcement, Ardoino acknowledged that the company’s survival ultimately depends on the discretion of U.S. regulators. "If the U.S. wanted to kill us, they can press a button and kill us anywhere,” Ardoino stated, adding that Tether’s approach is not to challenge U.S. authority directly.

Regulatory Compliance in a Whistleblower-Focused Era: How Companies Can Stay Ahead

With regulators intensifying scrutiny, companies today face growing pressure to strengthen their compliance programs, especially in an environment where whistleblower activity is on the rise. Both the Department of Justice (DOJ) and the Securities and Exchange Commission (SEC) have sharpened their focus on what they expect from businesses when it comes to managing risk, ensuring ethical behavior, and maintaining transparent operations.

DOJ Takes Aim at Visa’s Dominance in Debit Card Market: Antitrust Lawsuit Alleges Anti-Competitive Tactics

The U.S. Department of Justice has launched an antitrust lawsuit against Visa, accusing the payments giant of exploiting its dominance in the debit card market to stifle competition and impose exorbitant fees on consumers and businesses. The suit, filed in the U.S. District Court for the Southern District of New York, claims that Visa uses its market power to pressure merchants, banks, and financial institutions into using its proprietary payment processing network, resulting in billions of dollars in fees that are ultimately passed on to consumers.

DOJ and SEC Crack Down on Market Manipulation: Enforcement Actions Against Short Sellers Signal Increased Scrutiny

In a decisive move against market manipulation, the U.S. Department of Justice (DOJ) and the U.S. Securities and Exchange Commission (SEC) have launched parallel enforcement actions targeting prominent activist short seller Andrew Left and his firm, Citron Capital LLC. These actions underscore the increased scrutiny short sellers face and highlight the enduring prevalence of "short-and-distort" campaigns—where short sellers spread false or misleading information to drive down a company's stock price for financial gain.

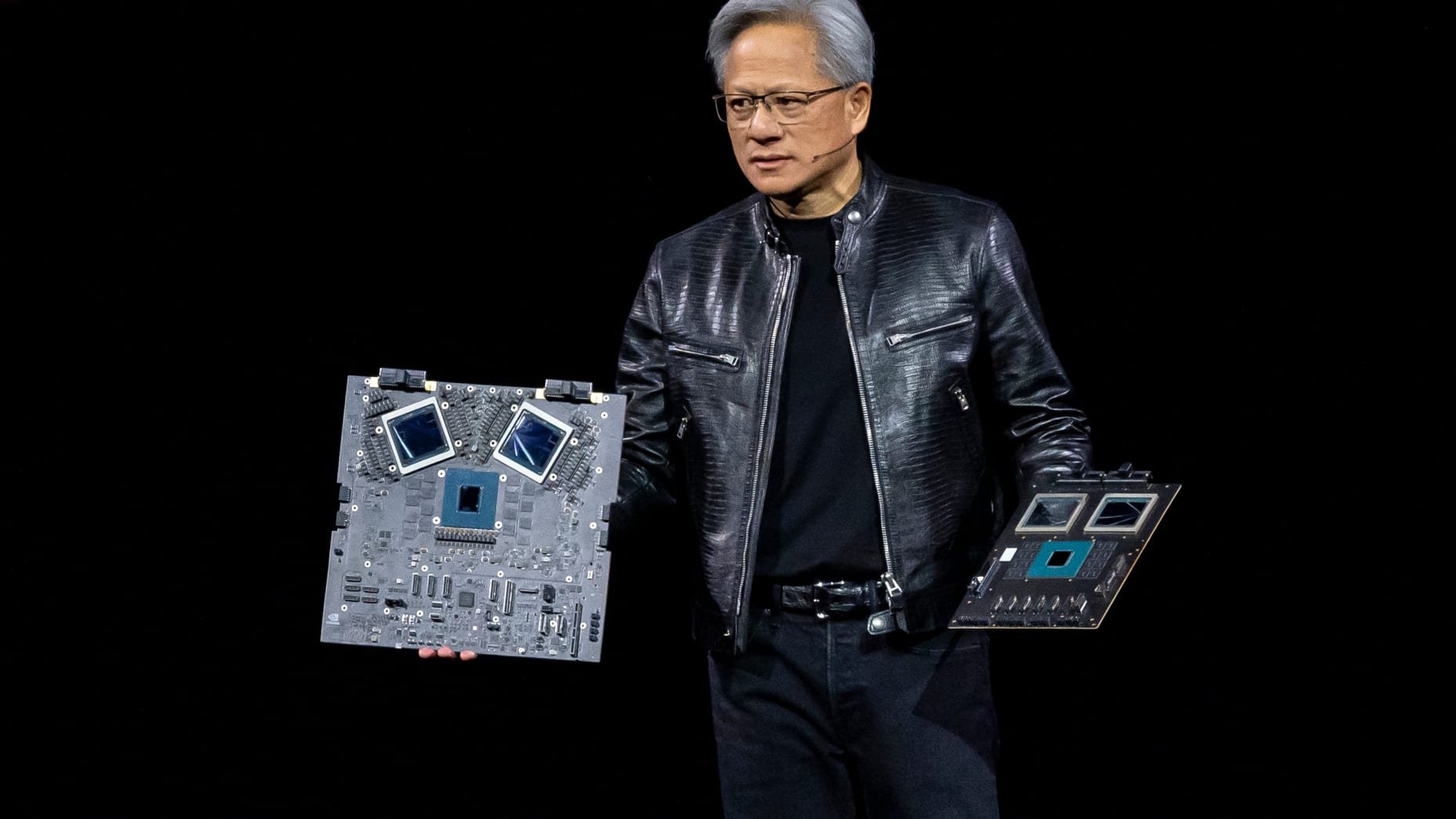

Nvidia Faces DOJ Antitrust Investigation: A Potential Turning Point in the AI Industry

The U.S. Department of Justice (DOJ) has significantly escalated its antitrust investigation into Nvidia Corp., the world’s leading AI chipmaker, by issuing subpoenas not only to Nvidia but also to third-party companies. This marks a critical step forward in a probe that has been quietly gaining momentum over the past several months. The investigation centers on whether Nvidia’s business practices have unfairly restricted competition in the rapidly growing AI chip market, with potential implications for the broader tech industry.

California Law Firm Settles False Claims Act Allegations Over Misuse of PPP Loan Funds

On August 15, 2024, a California-based law firm, along with senior managers, agreed to a settlement totaling $274,000 to resolve allegations of False Claims Act violations related to the misuse of Paycheck Protection Program (PPP) loan funds.

New Corporate Whistleblower Awards Pilot Program: A Game Changer for Corporate Accountability

On August 1, 2024, Principal Deputy Assistant Attorney General Nicole M. Argentieri unveiled a significant new initiative: the Corporate Whistleblower Awards Pilot Program. This program represents a strategic enhancement to the Department of Justice’s (DOJ) enforcement capabilities and aims to fortify corporate accountability across multiple sectors.