SEC Charges Accountant Olayinka Oyebola and His Firm With Aiding and Abetting Massive Fraud

The Securities and Exchange Commission (SEC) has taken significant enforcement action against Olayinka Oyebola and his accounting firm, Olayinka Oyebola & Co. (Chartered Accountants), alleging their role in a sprawling securities fraud orchestrated by Mmobuosi Odogwu Banye, a businessman with an ambitious—and, it turns out, fictitious—empire of U.S.-based companies.

SEC Charges Former Executives of Medly Health Inc. with Investor Fraud

The Securities and Exchange Commission (SEC) recently charged three former executives of the now-defunct digital pharmacy startup Medly Health Inc. with defrauding investors in a scheme that raised over $170 million. The charges underscore the SEC’s continued focus on corporate malfeasance, particularly within startups seeking capital from investors.

SEC Enforcement on Marketing Rule Violations: RIAs to Pay $1.2M in Fines

The SEC continues to flex its regulatory muscle over Registered Investment Advisors (RIAs) in its latest enforcement action targeting violations of the 2021 marketing rule. Nine RIAs have agreed to pay more than $1.2 million in collective fines for misleading advertising practices. The firms include prominent names like Integrated Advisors Network, Richard Bernstein Advisors, and Abacus Planning Group, each paying six-figure fines to settle charges brought by the commission.

Recent SEC Enforcement Action Highlights the Importance of Robust MNPI Policies in CLO Trading

In a significant enforcement action, the U.S. Securities and Exchange Commission (SEC) has sanctioned a private fund manager for failing to implement adequate policies and procedures to prevent the misuse of material nonpublic information (MNPI) while trading securities issued by collateralized loan obligation vehicles (CLOs). This case underscores the SEC’s focus on credit managers and emphasizes the importance of strong compliance frameworks for preventing MNPI violations in CLO trading.

DOJ and SEC Crack Down on Market Manipulation: Enforcement Actions Against Short Sellers Signal Increased Scrutiny

In a decisive move against market manipulation, the U.S. Department of Justice (DOJ) and the U.S. Securities and Exchange Commission (SEC) have launched parallel enforcement actions targeting prominent activist short seller Andrew Left and his firm, Citron Capital LLC. These actions underscore the increased scrutiny short sellers face and highlight the enduring prevalence of "short-and-distort" campaigns—where short sellers spread false or misleading information to drive down a company's stock price for financial gain.

SEC Fines Six Major Credit Rating Agencies for Recordkeeping Failures

The U.S. Securities and Exchange Commission (SEC) has imposed fines totaling $49 million on six major credit rating agencies for their failure to maintain and preserve electronic communications as required under federal securities laws. This action underscores the SEC's commitment to enforcing compliance with regulatory obligations that are crucial for maintaining the integrity of the financial markets.

SEC Targets OpenSea: The Potential Implications for the NFT Market

The Securities and Exchange Commission (SEC) has recently issued a Wells notice to OpenSea, the most prominent marketplace for non-fungible tokens (NFTs), signaling a potential lawsuit for securities law violations. This move marks a significant development in the SEC's ongoing scrutiny of the digital assets space, particularly as it relates to the burgeoning NFT market.

Court Denies SEC’s Request for Disgorgement in Ripple Case: Implications for Crypto Enforcement

In a notable development for the cryptocurrency regulatory landscape, a federal court has recently denied the Securities and Exchange Commission’s (SEC) request for disgorgement of profits in its case against Ripple Labs. This ruling, issued by Judge Analisa Torres of the US District Court for the Southern District of New York on August 7, 2024, marks a significant setback for the SEC’s efforts to impose substantial financial penalties in crypto cases primarily based on registration violations.

SEC Issues $24 Million in Whistleblower Awards: A Testament to the Power of Insider Cooperation

The Securities and Exchange Commission (SEC) continues to underscore the vital role that whistleblowers play in the enforcement of securities laws. On August 26, 2024, the SEC announced awards totaling more than $24 million to two whistleblowers whose information and assistance were instrumental in leading to successful enforcement actions, both by the SEC and another federal agency. This development is a compelling reminder of the significant public service provided by whistleblowers and the robust framework established to protect and reward them.

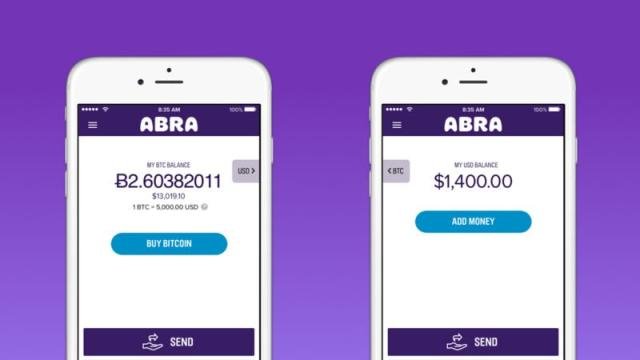

SEC Charges Abra with Unregistered Offers and Sales of Crypto Asset Securities

The SEC's recent enforcement action against Plutus Lending LLC, doing business as Abra, underscores the agency's unwavering commitment to ensuring that crypto asset offerings and sales comply with federal securities laws. The charges filed today highlight significant regulatory issues surrounding the unregistered offers and sales of crypto asset securities, specifically through Abra's retail crypto asset lending product, Abra Earn.

SEC Targets Standalone Investment Adviser in Groundbreaking Off-Channel Communication Enforcement Action

On April 3, 2024, the U.S. Securities and Exchange Commission (SEC) announced a landmark enforcement action against Senvest Management, LLC (Senvest), marking the first such action against a private fund adviser and a standalone investment adviser for failures related to off-channel communication recordkeeping. This case represents a significant development in the SEC’s ongoing enforcement efforts focused on recordkeeping failures in the financial industry.

2024 Mid-Year Review: SEC Enforcement regarding Crypto Assets

The Securities and Exchange Commission (SEC) has been highly active in 2024, particularly in the enforcement of regulations within the crypto asset space. As the digital asset market continues to evolve, so too does the regulatory landscape. The SEC’s actions reflect its commitment to protecting investors and maintaining fair, orderly, and efficient markets, even in the rapidly changing world of cryptocurrencies.

Navigating the SEC Whistleblower Program: Guidance for Whistleblowers and Companies Alike

The SEC’s Whistleblower Program, established under the Dodd-Frank Act, plays a pivotal role in uncovering and addressing violations of federal securities laws. While it provides significant incentives for individuals to report wrongdoing, it also poses substantial risks and challenges for companies whose employees may come forward as whistleblowers. Understanding the program's intricacies and how it impacts both whistleblowers and companies is crucial for navigating these situations effectively.

SEC Crackdown on Texting Violations: Asset Managers and Rating Agencies Brace for Next Round of Fines

The SEC’s relentless pursuit of record-keeping violations has reached new heights, as asset managers and rating agencies find themselves in the crosshairs of the regulator’s expanding probe into the use of personal devices for business communications. The investigation, which began in 2021 with a focus on investment bankers, has already resulted in over $2 billion in civil penalties from Wall Street firms. With recent settlements amounting to nearly $400 million from multiple firms, the SEC shows no signs of slowing down.

Supreme Court's Landmark Ruling in SEC v. Jarkesy: Implications for SEC Enforcement and Administrative Adjudication

On June 27, 2024, the U.S. Supreme Court issued a groundbreaking opinion in SEC v. Jarkesy, which fundamentally alters the landscape of securities enforcement and administrative adjudication. The Court’s decision unequivocally declared unconstitutional the SEC’s use of its in-house administrative courts to levy civil penalties in securities fraud cases. This ruling not only challenges the SEC’s procedural practices but also raises profound questions about the authority of federal agencies to seek similar forms of administrative relief.