Insights & Regulatory Updates

Recent SEC Enforcement Action Highlights the Importance of Robust MNPI Policies in CLO Trading

In a significant enforcement action, the U.S. Securities and Exchange Commission (SEC) has sanctioned a private fund manager for failing to implement adequate policies and procedures to prevent the misuse of material nonpublic information (MNPI) while trading securities issued by collateralized loan obligation vehicles (CLOs). This case underscores the SEC’s focus on credit managers and emphasizes the importance of strong compliance frameworks for preventing MNPI violations in CLO trading.

DOJ and SEC Crack Down on Market Manipulation: Enforcement Actions Against Short Sellers Signal Increased Scrutiny

In a decisive move against market manipulation, the U.S. Department of Justice (DOJ) and the U.S. Securities and Exchange Commission (SEC) have launched parallel enforcement actions targeting prominent activist short seller Andrew Left and his firm, Citron Capital LLC. These actions underscore the increased scrutiny short sellers face and highlight the enduring prevalence of "short-and-distort" campaigns—where short sellers spread false or misleading information to drive down a company's stock price for financial gain.

FINRA Prevails in Broker’s Post-Jarkesy Challenge to Disciplinary Hearing

The Financial Industry Regulatory Authority (FINRA) recently scored a legal victory after a federal judge in Philadelphia dismissed a broker’s challenge to a FINRA disciplinary proceeding, which was based on the U.S. Supreme Court’s Jarkesy decision. This decision provides some relief for both FINRA and the Securities and Exchange Commission (SEC), as they face increased scrutiny following the Supreme Court's ruling on administrative law judges.

SEC Fines Six Major Credit Rating Agencies for Recordkeeping Failures

The U.S. Securities and Exchange Commission (SEC) has imposed fines totaling $49 million on six major credit rating agencies for their failure to maintain and preserve electronic communications as required under federal securities laws. This action underscores the SEC's commitment to enforcing compliance with regulatory obligations that are crucial for maintaining the integrity of the financial markets.

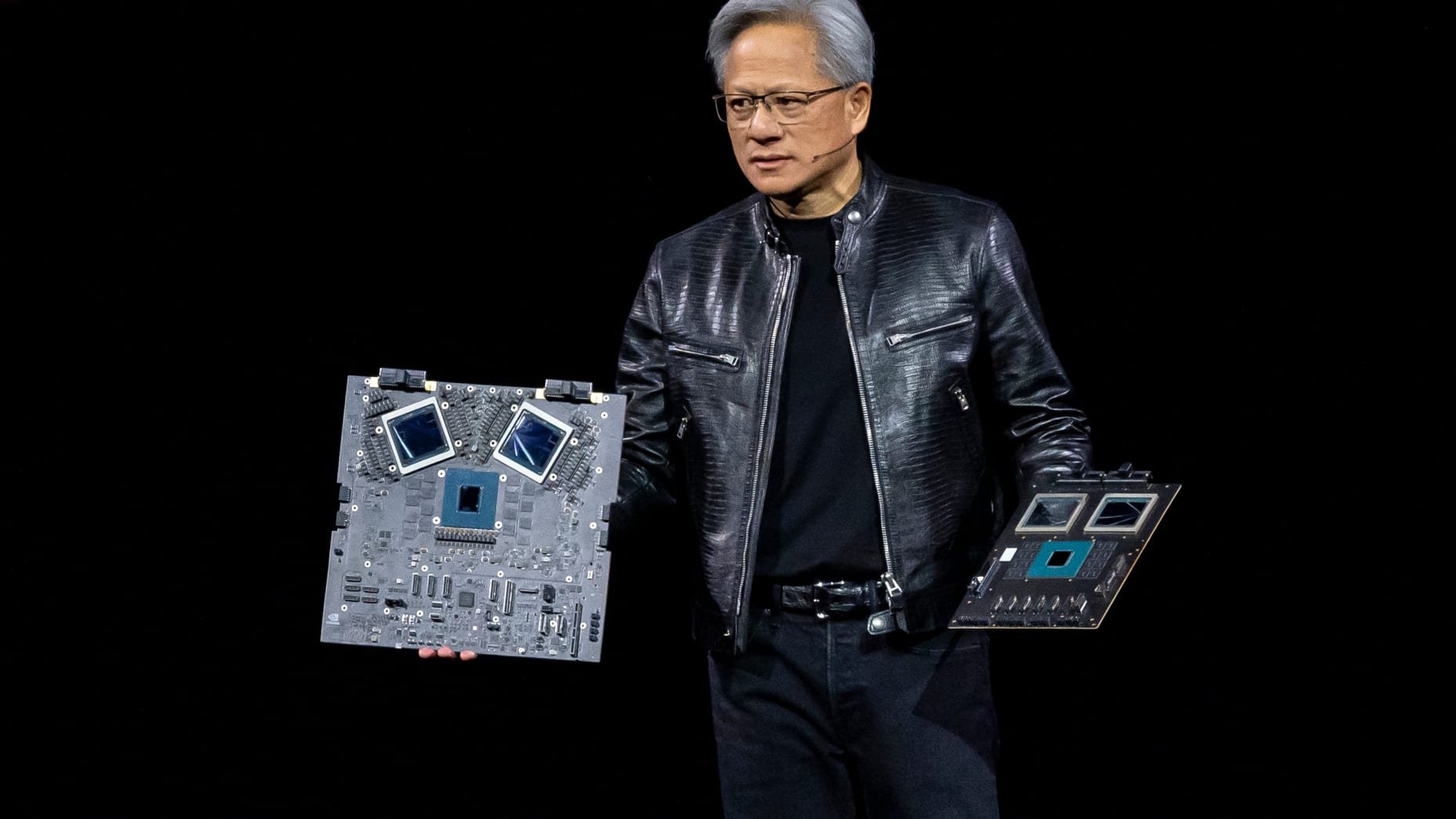

Nvidia Faces DOJ Antitrust Investigation: A Potential Turning Point in the AI Industry

The U.S. Department of Justice (DOJ) has significantly escalated its antitrust investigation into Nvidia Corp., the world’s leading AI chipmaker, by issuing subpoenas not only to Nvidia but also to third-party companies. This marks a critical step forward in a probe that has been quietly gaining momentum over the past several months. The investigation centers on whether Nvidia’s business practices have unfairly restricted competition in the rapidly growing AI chip market, with potential implications for the broader tech industry.

SEC Targets OpenSea: The Potential Implications for the NFT Market

The Securities and Exchange Commission (SEC) has recently issued a Wells notice to OpenSea, the most prominent marketplace for non-fungible tokens (NFTs), signaling a potential lawsuit for securities law violations. This move marks a significant development in the SEC's ongoing scrutiny of the digital assets space, particularly as it relates to the burgeoning NFT market.

FINRA Update on Crypto Asset Activities

On August 14, 2024, the Financial Industry Regulatory Authority (FINRA) issued an important update regarding its ongoing efforts to engage with its members on the subject of crypto asset activities. Referred to as "crypto assets," these are defined by FINRA as assets issued or transferred using distributed ledger or blockchain technology. These assets include virtual currencies, coins, and tokens, which may or may not meet the definition of "securities" under federal securities laws.

Former Broker Fined for Alleged Stock Hype in Client Emails: A Cautionary Tale for Advisors

On August 28, 2024, the Financial Industry Regulatory Authority (FINRA) announced the suspension and fining of Richard Joseph Jackson, a former broker, for allegedly engaging in misleading communications with clients regarding stock performance. This case underscores the critical importance of compliance with FINRA’s communication rules, particularly for financial professionals responsible for advising clients.

Court Denies SEC’s Request for Disgorgement in Ripple Case: Implications for Crypto Enforcement

In a notable development for the cryptocurrency regulatory landscape, a federal court has recently denied the Securities and Exchange Commission’s (SEC) request for disgorgement of profits in its case against Ripple Labs. This ruling, issued by Judge Analisa Torres of the US District Court for the Southern District of New York on August 7, 2024, marks a significant setback for the SEC’s efforts to impose substantial financial penalties in crypto cases primarily based on registration violations.

SEC Issues $24 Million in Whistleblower Awards: A Testament to the Power of Insider Cooperation

The Securities and Exchange Commission (SEC) continues to underscore the vital role that whistleblowers play in the enforcement of securities laws. On August 26, 2024, the SEC announced awards totaling more than $24 million to two whistleblowers whose information and assistance were instrumental in leading to successful enforcement actions, both by the SEC and another federal agency. This development is a compelling reminder of the significant public service provided by whistleblowers and the robust framework established to protect and reward them.

SEC Charges Abra with Unregistered Offers and Sales of Crypto Asset Securities

The SEC's recent enforcement action against Plutus Lending LLC, doing business as Abra, underscores the agency's unwavering commitment to ensuring that crypto asset offerings and sales comply with federal securities laws. The charges filed today highlight significant regulatory issues surrounding the unregistered offers and sales of crypto asset securities, specifically through Abra's retail crypto asset lending product, Abra Earn.

National Futures Association (NFA) Implements New Member Reporting Requirements

The National Futures Association (NFA) has introduced significant updates through Compliance Rule 2-52 and a corresponding Interpretive Notice. These new provisions, effective October 15, 2024, establish expanded reporting requirements applicable to all NFA Members, including those registered as commodity pool operators (CPOs) and commodity trading advisors (CTAs).

Top 10 Securities Enforcement Developments of Summer 2024

In this review, we highlight the top 10 securities enforcement developments of summer 2024, offering insights into the latest trends, landmark cases, and strategic shifts that are likely to influence compliance strategies and corporate governance moving forward. Whether you're navigating these issues in-house or advising clients, understanding these developments is essential for staying aligned with the evolving standards of securities law.

SEC Targets Standalone Investment Adviser in Groundbreaking Off-Channel Communication Enforcement Action

On April 3, 2024, the U.S. Securities and Exchange Commission (SEC) announced a landmark enforcement action against Senvest Management, LLC (Senvest), marking the first such action against a private fund adviser and a standalone investment adviser for failures related to off-channel communication recordkeeping. This case represents a significant development in the SEC’s ongoing enforcement efforts focused on recordkeeping failures in the financial industry.

Navigating New Risks: Key Insights from FINRA's 2024 Regulatory Oversight Report

The Financial Industry Regulatory Authority (FINRA) has recently issued its 2024 Annual Regulatory Oversight Report (the Report). This comprehensive 90-page document underscores evolving regulatory concerns and introduces several new areas of focus. Notably, the Report includes a dedicated section on cryptoasset developments and a detailed examination of market integrity topics, including the Securities and Exchange Commission (SEC) Market Access Rule.

FINRA Proposes Rules to Implement New Securities Lending and Transparency Engine (SLATE™)

On May 1, 2024, the Financial Industry Regulatory Authority (FINRA) proposed a new Rule 6500 Series to implement its Securities Lending and Transparency Engine (SLATE™). The new rule series is mandated by Rule 10c-1a under the Securities Exchange Act of 1934 (Exchange Act), which was adopted by the U.S. Securities and Exchange Commission (SEC) on October 13, 2023.

DOJ Announces New Pilot Program for Voluntary Self-Disclosures: What You Need to Know

The Department of Justice (DOJ) has introduced a new pilot program aimed at incentivizing individuals involved in corporate wrongdoing to voluntarily disclose information. This initiative, highlighted by Principal Deputy Assistant Attorney General Nicole M. Argentieri, underscores the DOJ’s commitment to enhancing accountability and uncovering hidden corporate misconduct.

California Law Firm Settles False Claims Act Allegations Over Misuse of PPP Loan Funds

On August 15, 2024, a California-based law firm, along with senior managers, agreed to a settlement totaling $274,000 to resolve allegations of False Claims Act violations related to the misuse of Paycheck Protection Program (PPP) loan funds.

New Corporate Whistleblower Awards Pilot Program: A Game Changer for Corporate Accountability

On August 1, 2024, Principal Deputy Assistant Attorney General Nicole M. Argentieri unveiled a significant new initiative: the Corporate Whistleblower Awards Pilot Program. This program represents a strategic enhancement to the Department of Justice’s (DOJ) enforcement capabilities and aims to fortify corporate accountability across multiple sectors.

Activist Short Seller Indicted for $16M Market Manipulation Scheme

On July 26, 2024, a federal grand jury in the Central District of California returned an indictment charging Andrew Left, a well-known activist short seller, with multiple counts of securities fraud. The indictment alleges that Left orchestrated a sophisticated market manipulation scheme that generated at least $16 million in illicit profits.