Update: The Supreme Court’s Decision in SEC v. Jarkesy and Its Broader Impact on SEC Enforcement

The Jarkesy ruling has considerable consequences for the SEC’s enforcement program. For years, the SEC has utilized its administrative forum to pursue civil penalties for securities fraud, with the flexibility to adjudicate matters in-house. However, the Supreme Court's decision effectively eliminates this option for cases seeking civil penalties. As a result, the SEC will likely need to shift more cases to federal court, where defendants are entitled to a jury trial. This shift could increase the complexity, time, and costs associated with SEC enforcement actions.

Broker-Dealer Fined $3M for Trading Supervision Failures

In a recent settlement with FINRA, a major broker-dealer agreed to pay over $3 million in monetary sanctions due to supervisory failures related to short-term trading recommendations. These trading activities, which spanned a two-year period from January 2017 to December 2018, resulted in client losses while generating significant profits for the firm.

SEC Charges Former Executives of Medly Health Inc. with Investor Fraud

The Securities and Exchange Commission (SEC) recently charged three former executives of the now-defunct digital pharmacy startup Medly Health Inc. with defrauding investors in a scheme that raised over $170 million. The charges underscore the SEC’s continued focus on corporate malfeasance, particularly within startups seeking capital from investors.

Navigating FINRA’s New Residential Supervisory Location (RSL) Rule

In response to the growing trend of remote work since the COVID-19 pandemic, FINRA has introduced a new rule under its supervision framework, allowing firms to designate private residences as Residential Supervisory Locations (RSLs). This significant development provides firms with an opportunity to adapt their supervisory practices to a more flexible work environment while ensuring compliance with FINRA’s stringent supervision requirements. Effective June 1, 2024, FINRA Rule 3110.19 enables firms to treat certain residential locations as non-branch locations, offering relief from the annual inspection requirements that apply to branch offices and Offices of Supervisory Jurisdiction (OSJs).

SEC Enforcement on Marketing Rule Violations: RIAs to Pay $1.2M in Fines

The SEC continues to flex its regulatory muscle over Registered Investment Advisors (RIAs) in its latest enforcement action targeting violations of the 2021 marketing rule. Nine RIAs have agreed to pay more than $1.2 million in collective fines for misleading advertising practices. The firms include prominent names like Integrated Advisors Network, Richard Bernstein Advisors, and Abacus Planning Group, each paying six-figure fines to settle charges brought by the commission.

Key Drivers Behind State Securities Enforcement Actions

State regulators play a pivotal role in maintaining the integrity of the securities industry, particularly when it comes to protecting retail investors. While federal agencies like the SEC often garner more attention, state securities regulators serve as critical front-line enforcers of compliance and ethical standards within their jurisdictions. Through targeted enforcement actions and oversight, state regulators address misconduct that can often slip through the cracks at the national level, ensuring that investment advisors and firms adhere to both state and federal regulations.

Massachusetts Investment Advisor Fined for Undisclosed WeChat Communications

In a recent enforcement action, a Massachusetts-based investment advisor has been sanctioned by the Financial Industry Regulatory Authority (FINRA) for conducting business communications through an unapproved messaging platform, in violation of recordkeeping rules. The advisor, formerly associated with a major brokerage firm, was found to have used WeChat, a Chinese social media application, to interact with clients without the firm's approval or proper documentation.

Opinion: U.S. Congress Must Establish a Clear Regulatory Framework for Crypto Assets to Maintain Western Leadership in Financial Innovation

By now, we all know that cryptographic blockchain has the potential to revolutionize the transfer of value over the internet—quickly, inexpensively, and without intermediaries. With mass-adoption, a blockchain-powered immutable public ledger of transactions could reshape financial systems globally. Yet, like any transformative technology, its long-term success hinges on legal and regulatory clarity. It is time for Congress to establish a comprehensive, sensible framework for regulating crypto assets.

Recent SEC Enforcement Action Highlights the Importance of Robust MNPI Policies in CLO Trading

In a significant enforcement action, the U.S. Securities and Exchange Commission (SEC) has sanctioned a private fund manager for failing to implement adequate policies and procedures to prevent the misuse of material nonpublic information (MNPI) while trading securities issued by collateralized loan obligation vehicles (CLOs). This case underscores the SEC’s focus on credit managers and emphasizes the importance of strong compliance frameworks for preventing MNPI violations in CLO trading.

DOJ and SEC Crack Down on Market Manipulation: Enforcement Actions Against Short Sellers Signal Increased Scrutiny

In a decisive move against market manipulation, the U.S. Department of Justice (DOJ) and the U.S. Securities and Exchange Commission (SEC) have launched parallel enforcement actions targeting prominent activist short seller Andrew Left and his firm, Citron Capital LLC. These actions underscore the increased scrutiny short sellers face and highlight the enduring prevalence of "short-and-distort" campaigns—where short sellers spread false or misleading information to drive down a company's stock price for financial gain.

FINRA Prevails in Broker’s Post-Jarkesy Challenge to Disciplinary Hearing

The Financial Industry Regulatory Authority (FINRA) recently scored a legal victory after a federal judge in Philadelphia dismissed a broker’s challenge to a FINRA disciplinary proceeding, which was based on the U.S. Supreme Court’s Jarkesy decision. This decision provides some relief for both FINRA and the Securities and Exchange Commission (SEC), as they face increased scrutiny following the Supreme Court's ruling on administrative law judges.

SEC Fines Six Major Credit Rating Agencies for Recordkeeping Failures

The U.S. Securities and Exchange Commission (SEC) has imposed fines totaling $49 million on six major credit rating agencies for their failure to maintain and preserve electronic communications as required under federal securities laws. This action underscores the SEC's commitment to enforcing compliance with regulatory obligations that are crucial for maintaining the integrity of the financial markets.

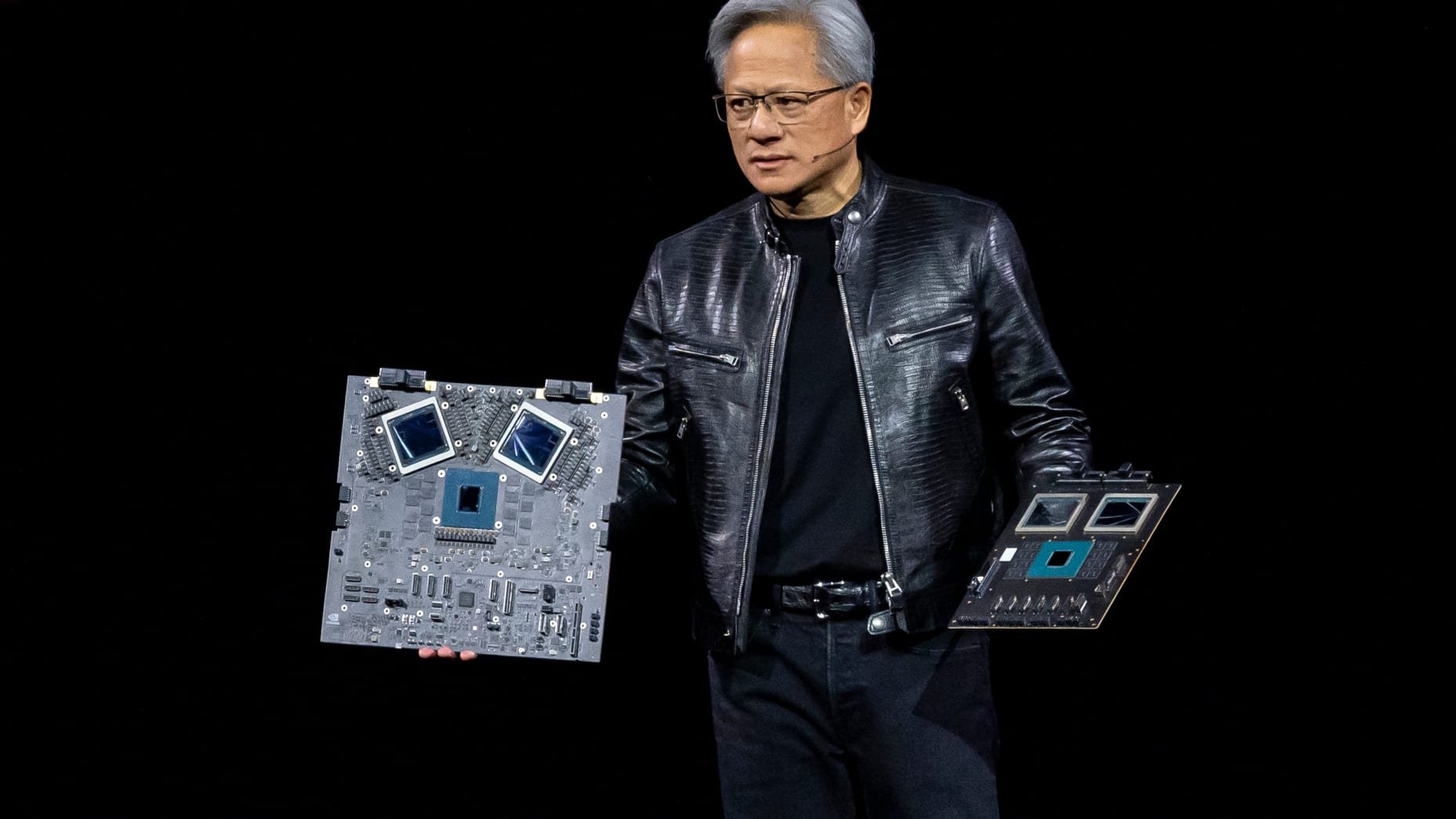

Nvidia Faces DOJ Antitrust Investigation: A Potential Turning Point in the AI Industry

The U.S. Department of Justice (DOJ) has significantly escalated its antitrust investigation into Nvidia Corp., the world’s leading AI chipmaker, by issuing subpoenas not only to Nvidia but also to third-party companies. This marks a critical step forward in a probe that has been quietly gaining momentum over the past several months. The investigation centers on whether Nvidia’s business practices have unfairly restricted competition in the rapidly growing AI chip market, with potential implications for the broader tech industry.

SEC Targets OpenSea: The Potential Implications for the NFT Market

The Securities and Exchange Commission (SEC) has recently issued a Wells notice to OpenSea, the most prominent marketplace for non-fungible tokens (NFTs), signaling a potential lawsuit for securities law violations. This move marks a significant development in the SEC's ongoing scrutiny of the digital assets space, particularly as it relates to the burgeoning NFT market.

FINRA Update on Crypto Asset Activities

On August 14, 2024, the Financial Industry Regulatory Authority (FINRA) issued an important update regarding its ongoing efforts to engage with its members on the subject of crypto asset activities. Referred to as "crypto assets," these are defined by FINRA as assets issued or transferred using distributed ledger or blockchain technology. These assets include virtual currencies, coins, and tokens, which may or may not meet the definition of "securities" under federal securities laws.

Former Broker Fined for Alleged Stock Hype in Client Emails: A Cautionary Tale for Advisors

On August 28, 2024, the Financial Industry Regulatory Authority (FINRA) announced the suspension and fining of Richard Joseph Jackson, a former broker, for allegedly engaging in misleading communications with clients regarding stock performance. This case underscores the critical importance of compliance with FINRA’s communication rules, particularly for financial professionals responsible for advising clients.

Court Denies SEC’s Request for Disgorgement in Ripple Case: Implications for Crypto Enforcement

In a notable development for the cryptocurrency regulatory landscape, a federal court has recently denied the Securities and Exchange Commission’s (SEC) request for disgorgement of profits in its case against Ripple Labs. This ruling, issued by Judge Analisa Torres of the US District Court for the Southern District of New York on August 7, 2024, marks a significant setback for the SEC’s efforts to impose substantial financial penalties in crypto cases primarily based on registration violations.

SEC Issues $24 Million in Whistleblower Awards: A Testament to the Power of Insider Cooperation

The Securities and Exchange Commission (SEC) continues to underscore the vital role that whistleblowers play in the enforcement of securities laws. On August 26, 2024, the SEC announced awards totaling more than $24 million to two whistleblowers whose information and assistance were instrumental in leading to successful enforcement actions, both by the SEC and another federal agency. This development is a compelling reminder of the significant public service provided by whistleblowers and the robust framework established to protect and reward them.

SEC Charges Abra with Unregistered Offers and Sales of Crypto Asset Securities

The SEC's recent enforcement action against Plutus Lending LLC, doing business as Abra, underscores the agency's unwavering commitment to ensuring that crypto asset offerings and sales comply with federal securities laws. The charges filed today highlight significant regulatory issues surrounding the unregistered offers and sales of crypto asset securities, specifically through Abra's retail crypto asset lending product, Abra Earn.

National Futures Association (NFA) Implements New Member Reporting Requirements

The National Futures Association (NFA) has introduced significant updates through Compliance Rule 2-52 and a corresponding Interpretive Notice. These new provisions, effective October 15, 2024, establish expanded reporting requirements applicable to all NFA Members, including those registered as commodity pool operators (CPOs) and commodity trading advisors (CTAs).